Three ways to get into the Austin housing market when affordability is an issue

With Austin home prices on the rise, many people are getting priced out of the market. Homes that were once within reach are now priced hundreds of thousands of dollars more than they were just a few months ago. The rapid price escalation has exacerbated Austin’s existing affordability issues, and many buyers are watching their dream of home ownership slip further way.

No doubt, it can be tough for Austin homebuyers right now, but there are ways to overcome affordability challenges. Here are three ways you can get into the housing market when affordability is a concern.

OPTION 1. Purchase a multi-unit property (duplex etc.) instead of a single family home

Real estate is expensive if you’re paying for it all by yourself, but it becomes a lot more affordable when you have someone else helping with your monthly mortgage expenses. We call that house hacking.

Of course, you could always have a roommate or two, but we’re actually talking about how you can live in your own home without a live-in roommate. This is where multi-unit properties come in. A multi-unit property, like a duplex or fourplex, essentially has more than one unit or home in the same building and under the same roof. And if you buy a property with more than one unit, you have the opportunity to rent it out and apply the rent you receive toward offsetting your own mortgage. You become a landlord with tenants that pay you rent.

There are a lot of benefits to this set up. First off, as an owner-occupant you can often put as little as 15% down. In contrast, investors have to come up with a 25% down payment. It’s also easier to qualify for your home loan, as most lenders will consider your income + 75% of one of your tenant’s rents. To the lender it’s like you got a raise, and you have more buying power. Most importantly, you get to defray your personal living expenses (mortgage and so on) when the other units in your home are occupied.

We like house hacking because it allows you to enter the housing market and begin to build your real estate portfolio quickly with less of your own money. That said, there are some things to look out for. For starters, one of the units needs to be available for you to live in within 60 days of purchase. It also comes with the added responsibility of managing the repairs and rental of the other units. You will want to have a handy person that you trust to make minor updates and repairs, as well as a good list of other specialized trades you will need from time to time. This is part of home ownership in general, but with a multi-unit property you are also responsible for the upkeep of your tenant’s units too. And of course, you have to be prepared to pay the entire mortgage during those times when you other units are vacant.

Multi-unit properties are a great way to get into the Austin real estate market, and put some of Austin's local price appreciation to work building your own wealth. We’ve had a lot of clients through the years that started out this way, and now own multiple investment properties that have appreciated nicely. The idea is to buy one, live in it for awhile, buy another one and move into it, and so on until you’ve accumulated enough equity that you can buy a single family home.

Potentially you could own as many as 10 units, but we suggest living there for at least one year before moving out and buying your next property. Purchasing the second property as an owner-occupant can be a little tricky, especially if you are moving to a fourplex or something less home-like. Another duplex in a better location or something along those lines is often a better move.

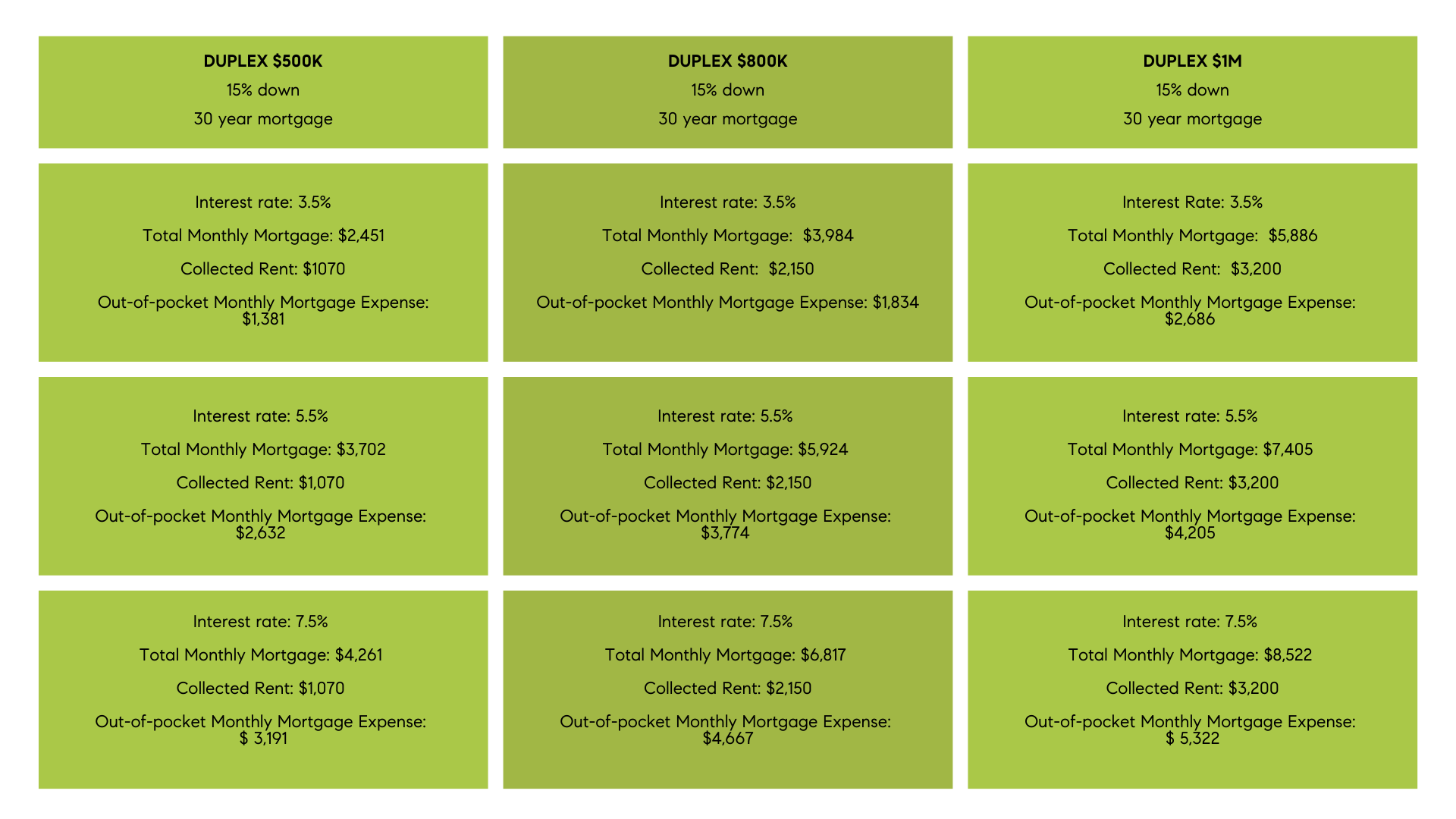

If you like this idea, we will gladly find you some multi-unit properties in Austin that would work well for house hacking. Check out how these scenarios break down, assuming you purchase them on a 30 year mortgage after making a 15% down payment:

Interesting, right? With Austin home prices on the rise, house hacking can be a great way to get into home ownership and begin to build your real estate investment portfolio all at the same time. If you find this intriguing, the numbers are even more powerful with a fourplex. We should talk!

OPTION 2: Consider condominiums or townhomes as your starter home

While you may have your heart set on a single family home, your money may go further if you adjust your search and consider a condominium or a townhome. These properties are often less than a single family home in the same neighborhood, and that means your money can go further.

Remember, this does not have to be your forever home. This first purchase is a starting place to get a foothold in the market. Then it’s a waiting game as you allow some of Austin’s price appreciation to help you build wealth so that you can buy something more in line with your long-term goals at a future date.

OPTION 3: Consider a property in a neighboring suburb

Another option for getting started in the Austin real estate market is to broaden your search to include our suburban cities. Home prices are appreciating everywhere, the suburbs included. The difference is that these homes often start at a lower price point so that you may have greater luck finding something in your price point. Many of the suburbs also have newer home communities so you can find properties that have more upgrades than you might find for the same price within the City of Austin.

You can do it!

With Austin home prices continuing to rise, the important thing is to get into the market so that you can put price escalation to work for you instead of against you.

By being flexible in your home search it is possible to buy a home and keep your mortgage reasonable. Then after awhile you can turn that initial investment into the home you want. Just be patient.

And keep in mind, the longer you wait, the more expensive homes are becoming.

If you want more help on how to make your dream of owning a home an actual reality, please reach out.

.jpg)

.jpg?w=128&h=128)

.png)

.jpg)